Contents

All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Even if you’re sure that your flag is going to see a continuation, it’s always worth paying attention to risk management as part of your strategy. One useful way to confirm a flag is to watch the market’s volume. In a bullish flag, volume should be high during the initial uptrend, then peter out as the market consolidates.

So, if you were trading a bullish flag, then your stop should be placed below the lowest bottom in the Flag. Conversely, if you were trading a bearish Flag, then your stop should be placed above the highest top in the Flag. If you have a bullish flag, you will buy the Forex pair when the price action closes a candle above the upper side.

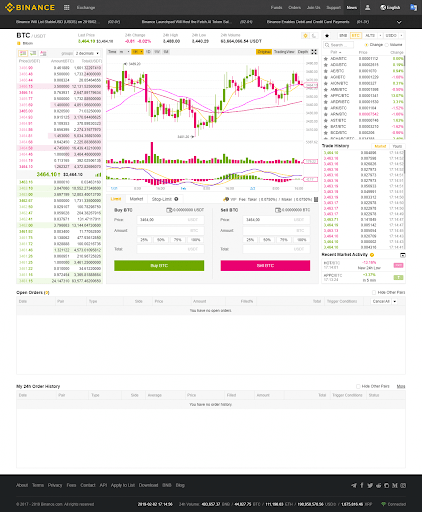

Flag Pattern Trade Entry

The chart also shows that the best position for you to buy the currency pair is at the point where the Flag breaks out through the upper level of the Flag. I want to demonstrate how to perform technical analysis on this formation using a graphic. If you had bought the currency pair in any of the bull Flags, you would have made profit. The reason is that the price action has maintained an upward trend throughout. In the above chart, there is a strong price action to the upwards.

Now on your remaining trade, you adjust your stop again so that it will be located just below the second target. If the price continues to trend upwards, then you could carefully monitor price action and bitit review hold the last 1/3 of the trade position for as long as it seems prudent. Most times, after the Flag completes the two targets, you would want to close out the entire position and bank your profits.

- In today’s lesson we discuss the pennant, triangle, wedge, and flag chart patterns, but there are many others you can also use and you will find lessons for on this site.

- Before deciding to trade forex and commodity futures, you should carefully consider your financial objectives, level of experience and risk appetite.

- Identifying Elliott Wave patterns can seem confusing, especially if you are looking to differentiate between a flat or a zigzag pattern.

- More details about how to trade a bullish or a bearish flag can be found out by watching the videos with this educational article.

A good example is when it’s trading above the 20-period moving average. The first pullback that occurs after that breakout has been shown. From my experience, there are two times when you should trade the Flag pattern. Again, just as we did with Target 1, this distance should be applied from the start of the breakout point.

Top 5 Best Forex Trend Following Strategies That Work

The 3-drive chart pattern consists of three impulsive waves and two retracement waves. The number three is also a Fibonacci number, and it has much importance in trading. That’s why the three-drive pattern is also a natural phenomenon. The chart pattern changes the price trend from bearish to bullish. The neckline is drawn at the last price swing after two price bottoms in this pattern.

They quickly bid up the price , but the move eventually reaches a climax. When the market slows down, early birds take profits, and a countermove develops where the market relinquishes some of its gains . You could, for instance, move both your stop and take profit as the market approaches the first profit target. To be a valid pattern, the flag needs to satisfy some basic criteria. Firstly the body of the flag should align in a different direction to the trend. The body may be horizontal or nearly horizontal in some cases.

Introduction to Types of Flag Patterns and how to draw flags correctly

After breaking out of the flag pattern, price rallies to reach not only the minimum price objective but rallies to make higher highs. The stops for the bullish flag are placed just at the low prior to the break out from the bullish oanda review flag. It is kind of a combination of flags and pennants, with an upward or downward movement in range before the price breaks and continues its original direction. Maybe you are wondering how to identify each of these patterns.

The difference between these two is the shape of the correction that comes after the Flag Pole. The chart also shows the position where you should place your first stop loss order. The position of the Flag is shown using kraken trading review two black lines running parallel to each other. You’re now becoming familiar with how to trade the Flag pattern. Of course, you will have your own trade management style that suits you, and this applies to other traders.

How to Trade Bullish Flag Patterns

The flag pattern strategy involves measuring the distance between the parallel lines which form the flag. When the flag is 30 pips wide or more before it breaks out, the price move will continue in the same direction as the breakout trend. The key to flag patterns is knowing when a breakout will occur when the market consolidates after a sharp price move. Trading forex flag patterns will help you here because the trade is delayed until there’s a decent retracement as it is needed to identify the flag portion of the pattern.

Can you explain a bit more about your method for detecting the patterns as well because there can be huge variation depending on the system being used. You can have two different methods but those will often pick entirely different trade entry times. And that obviously makes a difference in terms of the trading profit.

The bull flag chart pattern looks like a downward sloping channel/rectangle denoted by two parallel trendlines against the preceding trend. This chart pattern can also act as a trend reversal pattern. It depends on the location either it forms during a bullish trend or begins at the end of the bearish trend. The flags and pennant patterns can be a good way to trade chart patterns. As seen by the above chart, the bearish pennant pattern is identified by converging trend lines forming a pennant that is sloping upwards at the bottom end.

Reasons Behind the “Flag” Chart Pattern Formation

The Stop Loss order of this trade stays below the lowest point of the Flag as shown on the image. In this case, however, the market may not to provide a trade trigger , so you sometimes spare the loss by not having an open trade. Of course, you don’t want to miss the next big move down, but you also don’t want to enter too early while the market is still retracing. To trade this we’d place orders to buy at or around the end of the box. Therefore the best strategy is to average in to the market by placing a sequence or grid of buy orders at that point. To put it another way, the flag itself marks a brief correction in a trend.

Forex.Academy is a free news and research website, offering educational information to those who are interested in Forex trading. Forex Academy is among the trading communities’ largest online sources for news, reviews, and analysis on currencies, cryptocurrencies, commodities, metals, and indices. Eduardo Vargas is a technical analyst and independent trader based in Buenos Aires, Argentina. He is an Industrial Engineer and holds a Master in Finance degree.

Trading the Flag

The Head of the pattern has a couple of bottoms from both of its sides. The line connecting these two bottoms is called a Neck Line. When the price creates the second shoulder and breaks the Neck Line in a bearish direction, this confirms the authenticity of the pattern. To enter a Double Top trade, you would need to see the price breaking through the level of the bottom that is located between the two tops of the pattern. We will discuss the bullish version of the pattern, the Double Top chart pattern, to approach the figure closely.

Once price has reached the top of its pole, it slants against the trend to form a channel, which is called the “flag”. The next chart below, Figure 4 shows an example of how the bearish flag is traded. In the red circle we see the breakout through the upper level of the pattern – the confirmation. The first one equals the size of the wedge – marked with the smaller pink arrow. Both should be applied starting from the moment of the breakout.