Contents:

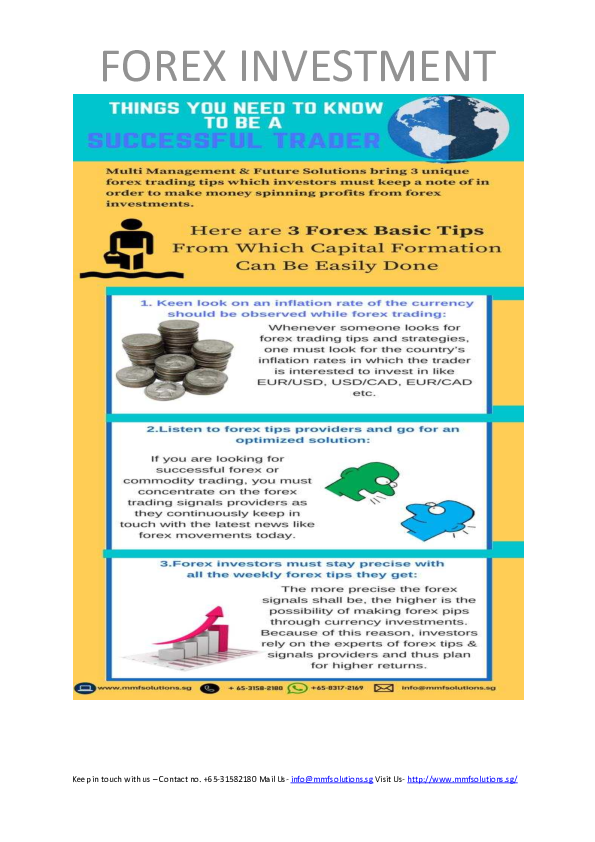

A tax system should be simple enough to enable a tax payer to understand it and be able to compute his/her tax liability. A complex and difficult to understand tax system may produce a low yield as it may discourage the tax payer’s willingness to declare income. It may also create administrative difficulties leading to inefficiency. The most simple tax system is where there is a single tax. However, this may not be equitable as some people will not pay tax.

chart of accounts example reform must be done in a way that raises significant revenue, protects working families and the vulnerable, and requires corporations and the wealthy to pay a fair share. These tax principles apply to all taxes in all countries. Furthermore, these principles apply to all individuals involved in managing or directing RELX’s tax affairs. Competitiveness – A low tax burden can be a tool for a state’s private sector economic development by retaining and attracting productive business activity.

Tax System And Its Principles

These factors become more of a threshold rather than just a guiding principle in developing markets compared to developed ones. This is because of illiteracy, lack of proper channels to resolve ambiguities, and prevalent administrative challenges. Concept Of Horizontal EquityHorizontal equity is a tax treatment that a particular class of individuals who earn the same income should also pay the same income tax. There should be no discrimination between any two persons regarding their savings, expenditure, and deductions claimed but should be leviable with the same income tax.

- Lewis has taught university accounting for over five years.

- While couples neutrality proposes a joint taxation of married couples, marriage neutrality requires couples to be taxed individually.

- These factors become more of a threshold rather than just a guiding principle in developing markets compared to developed ones.

- Overall, variation in tax endorsement between countries is low.

- In designing an income tax system, for many developing countries, the focus is how they can increase revenue rather than a question of “if they should”.

Constitutional limitations • Concurrence by a majority of all members of the Congress for the passage of a law granting any tax exemption. • Power of the President to veto any particular item or items in a revenue or tariff bill. • Non-impairment of the jurisdiction of the Supreme Court in tax cases.

WHY THE GOVERNMENT LEVIES TAXES

They only represent a small fraction of the tax policies we delve into every day. For more information about our principles and how they can be applied in practice, please contact us here. An example of the benefits principle would be transportation system taxes. If someone were to make less than $15,000 a year, for instance, their tax rate might be 10%. But for someone who earns between $15,000 and $50,000, their tax rate might be 12%.

Financial literacy education in Erie starts with teaching youth – GoErie.com

Financial literacy education in Erie starts with teaching youth.

Posted: Mon, 24 Apr 2023 09:12:43 GMT [source]

Figure 4 depicts the predicted endorsement for each of the 27 designs . This figure again shows that overall Germans endorse a net wealth tax more than the British and Americans. For all three countries, any tax design with an exemption of 0.5 million is the least favourite.

Our global tax contribution

Members of Group Tax partner with managers across the businesses to ensure they are aware of changes and are given appropriate advice and support. We do not use our commercial bargaining power in any given country or region to obtain company-specific tax advantages that are not available to all market participants, or which are otherwise not properly legislated. We do not artificially transfer profits from one business location to another to avoid taxation. We aim to pay an appropriate amount of tax according to where value is created within the normal course of commercial activity. SmartBook 2.0 fosters more productive learning, taking the guesswork out of what to study, and helps students better prepare for class.

But this discussion is worth not having without answering the following fundamental question. Implementing tax on sugar-sweetened beverages was correlated with substantial increase in soda rates and decrease significant consumption of aerated drinks, sweet teas, flavored water, and sport drinks. In Australia people are getting fat since childhood caused by eating too much unhealthy processed food which address complex disease called obesity. World Health Organization suggests that obesity is a risk factor for most of non-communicable disease such as type 2 diabetes, cardiovascular disease , cancer etc.

With regard to a wealth tax, inherited policy design might shape cross-country differences in wealth tax preferences. Be prepared to advise about tax policy issues or manage tax administration. Understand the complicated sources of tax law and the ways that specific tax rules vary across the many different taxing jurisdictions. Then, learn the common principles that exist in the types of direct and indirect taxes imposed and in the methodology behind corporate and individual tax systems.

Determining the answers to these questions isn’t straightforward and can become messy rather quickly. That’s why some governments choose not to use the benefits principle and instead choose to use a different tax structure that would allow for at least a partial redistribution of wealth. Lower-income taxpayers might have a greater shot at bettering their financial status under that type of structure since less of their earnings would go toward taxes. This sort of approach also serves individuals who cannot afford to pay. Both hypotheses were preregistered with a slightly different wording. We thus only deviate from our preregistered hypotheses insofar as we tried to make the hypotheses’ focus on the relative difference in the preferred tax design within countries more explicit.

Overall, variation in tax endorsement between countries is low. Because attitudes towards taxes are multidimensional and may depend on the specific configuration of the tax design, asking single-item questions provides only limited insights into individuals’ reasoning. Therefore, we randomly present respondents with different hypothetical designs of a net wealth tax and ask about their endorsement of these designs. In the experiment, respondents are indirectly asked to weigh the design elements . The random assignment of vignettes to respondents makes it possible to examine not only the general public endorsement of a net wealth tax but also the relative importance of different design elements for tax preferences. There is a meaningful difference between a multimillionaire and a family earning $250,000 a year that our tax code fails to recognize.

Our approach to tax

RELX performs to the highest commercial and ethical standards and channels our knowledge and strengths, as global leaders in our industries, to make a difference to society. We make a positive impact on society through our knowledge, resources and skills, including supporting the tax authorities and promoting of the rule of law and justice. RELX contributes in many ways to the jurisdictions in which we operate. This report concentrates on our tax contribution which is just one element of our overall contribution. Total tax contribution quantifies the total amount of taxes generated by RELX and contributed to the public finances.

During a period of significant disruption, the toolkit proved to be a critical resource in helping businesses across the country. We prepare and maintain all documentation required by law, as well as anywhere necessary to provide support for a transaction with a tax impact. Relative taxable capacity is measured by comparing the absolute taxable capacities of different individuals or communities. Funds collected from taxes can be used on public works programmes like roads, drainage, and other public buildings. If manual labour is used to complete these programmes, more employment opportunities are created.

Income and sales taxes are the main revenue source for most states. While some people file returns only at the close of a financial year, tax authorities continuously deduct taxes through payroll and other related deductions. They also require businesses to file and pay estimated and quarterly taxes throughout the year, known as a pay-as-you-go method. We apply a multifactorial vignette survey experiment to examine the population’s attitudes towards a net wealth tax in three countries . Our results show that individuals in general endorse a net wealth tax but prefer larger tax exempted amounts. The effect of the level of tax exemption exceeds by far the effect of the tax unit or the tax rate.

By increasing the complexity of the tax code, the web of requirements and restrictions across these accounts complicates saving decisions and disincentivizes saving altogether. The Tax Cuts and Jobs Act of 2017 simplified the federal tax code by doubling the standard deduction, which the Joint Committee on Taxation estimated has resulted in nearly30 percentfewer filers itemizing. Earn points, unlock badges and level up while studying.

CalMoneySmart 2023-24 – California Grants Portal – California Grants Portal

CalMoneySmart 2023-24 – California Grants Portal.

Posted: Fri, 21 Apr 2023 22:20:07 GMT [source]

Introduction According to WHO, the four major non-communicable diseases in the world include of cardiovascular diseases, diabetes, cancer and chronic respiratory diseases. Poor diet and obesity are most common preventable risk factor for the occurrence of the NCDs. While in Australia 90% of the deaths occur due to NCDs In 2015, 19.7% of the deaths and 9.5% DALYs occurred due to NCDs caused by poor diet.

The tax affairs of RELX are managed by a team of suitably qualified tax professionals, supported where appropriate by external advisors. Training is provided to employees to ensure that tax compliance is carried out with a suitable level of diligence and technical expertise. Complementary – The tax code should help maintain a healthy relationship between the state and local governments.

More detail on the corporate income taxes reflected in our annual accounts can be found in note 9 of RELX’s 2022 annual report. The reconciliation of our effective tax rate to the weighted average expected rate is reproduced below. Simplicity – The tax code should be easy for the average citizen to understand, and it should minimize the cost of complying with the tax laws. Tax complexity adds cost to the taxpayer, but does not increase public revenue.